Increasing the Average Order Value (AOV), or basket size, means customers spend more on your products and services when making a transaction. And marketing automation can play a vital role in achieving this without the need for additional budget, resource, or time.

In this blog post, we explore five ways that finance brands can leverage marketing automation to drive higher AOV, without resorting to hard selling.

Understanding Average Order Value (AOV) in Finance

Average Order Value (AOV) is a key metric for finance brands, representing the average amount a customer spends in a transaction.

In financial services, increasing AOV might mean encouraging customers to invest more, upgrade to premium banking services, or take advantage of additional financial products such as insurance or savings management solutions.

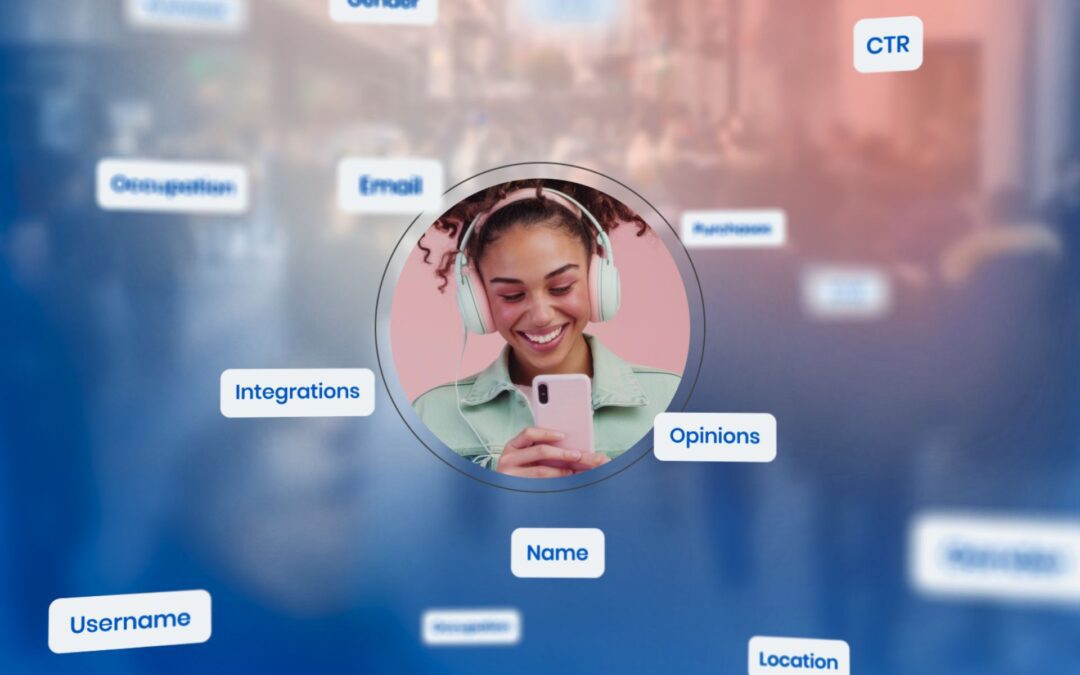

Rather than focusing solely on acquiring new customers, finance brands can utilise marketing automation to nurture existing clients, guiding them toward higher-value decisions. With personalised recommendations, enticing incentives, and well-timed messaging, businesses can enhance customer experience whilst naturally increasing transaction values.

This not only boosts revenue but also strengthens long-term customer relationships, making financial services more valuable and relevant to each individual.

Strategies to Increase AOV Using Marketing Automation

Marketing automation allows finance brands to create personalised, data-driven campaigns that engage customers at the right time with the right promotions. Whether through tailored cross-selling, bundled services, or reward-based incentives, automation helps encourage customers to explore higher-value products and services.

Below, we explore key strategies to achieve this:

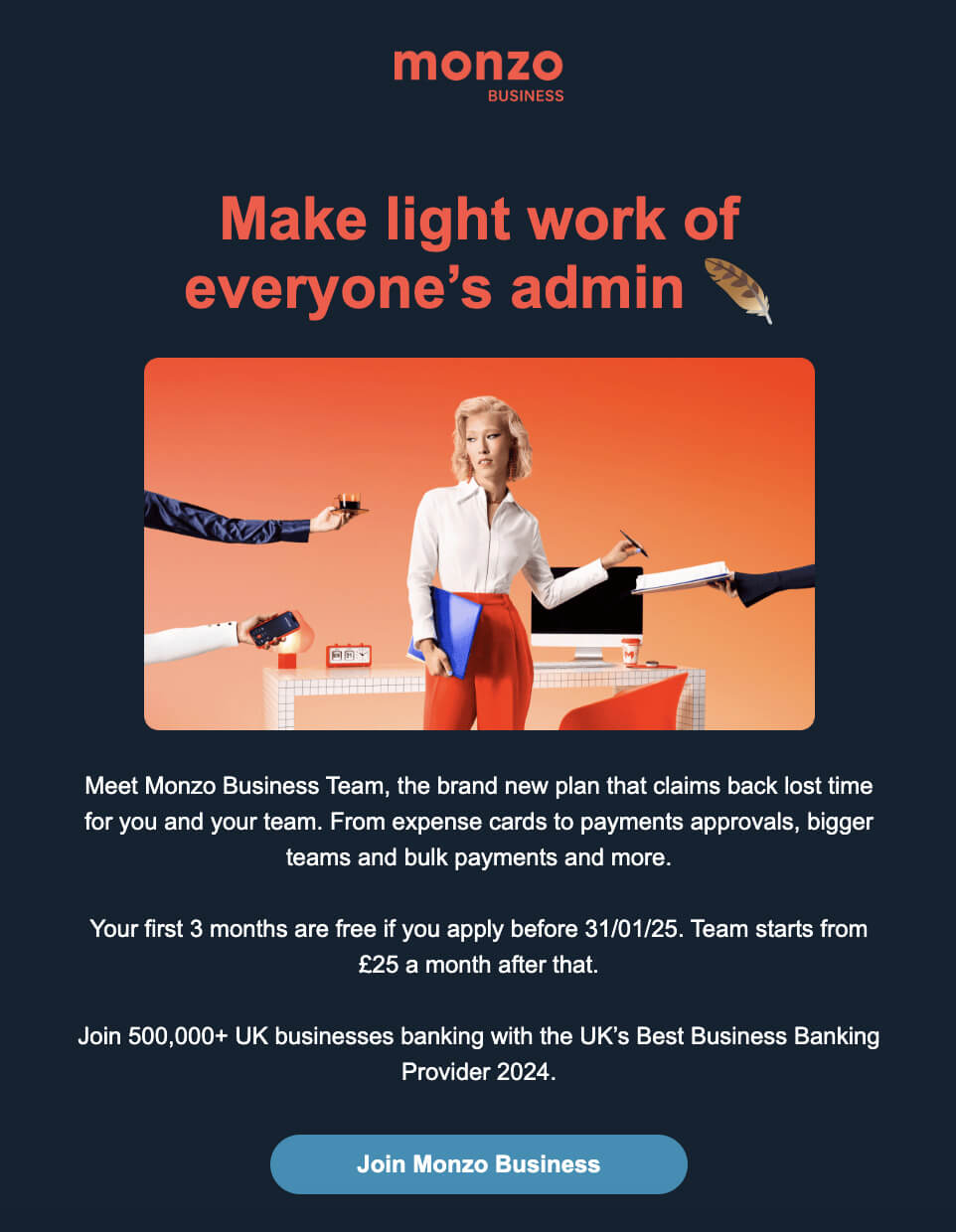

Personalised Cross-Selling and Upselling

Marketing automation empowers finance brands to better understand customer behaviour and therefore deliver highly relevant product recommendations at just the right moment. With the use of dynamic content, highly relevant product or service suggestions can be presented via email or landing pages, offering cross-sell and upsell opportunities that align with each customer’s financial needs.

For example, a customer in the process of signing up for a basic savings account could receive a personalised offer highlighting the benefits of upgrading to a high-interest savings account. This recommendation would feel intuitive rather than intrusive, increasing the likelihood of customer engagement.

When done well, this level of personalisation builds trust and strengthens customer relationships, making it easier to encourage them to explore and invest in higher-value financial products.

Dynamic Bundling of Services

Offering bundled financial products at a discounted rate or with added perks is a great way to enhance customer value whilst increasing overall spend.

With marketing automation, finance brands can intelligently curate and present these bundle options based on individual customer preferences and financial goals, ensuring they receive the most relevant and enticing offers.

For instance, if a customer is applying for a mortgage, marketing automation can instantly suggest a tailored bundle that includes home insurance. By streamlining this process and delivering timely, personalised recommendations, brands can enhance the customer experience whilst encouraging higher-value transactions.

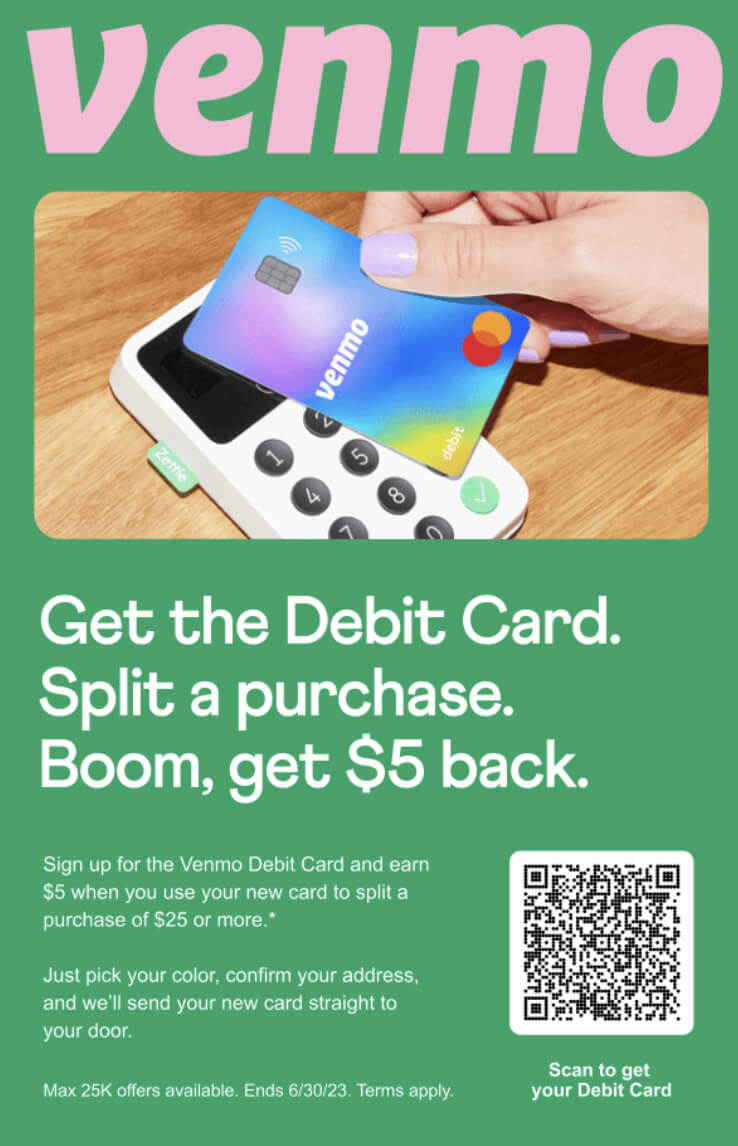

Implementing Loyalty Programmes

A well-designed loyalty programme does more than just keep customers engaged, it encourages them to spend more by offering meaningful rewards for their continued business.

With marketing automation, finance brands can effortlessly create and manage tailored loyalty schemes that motivate customers to increase their spending during a transaction.

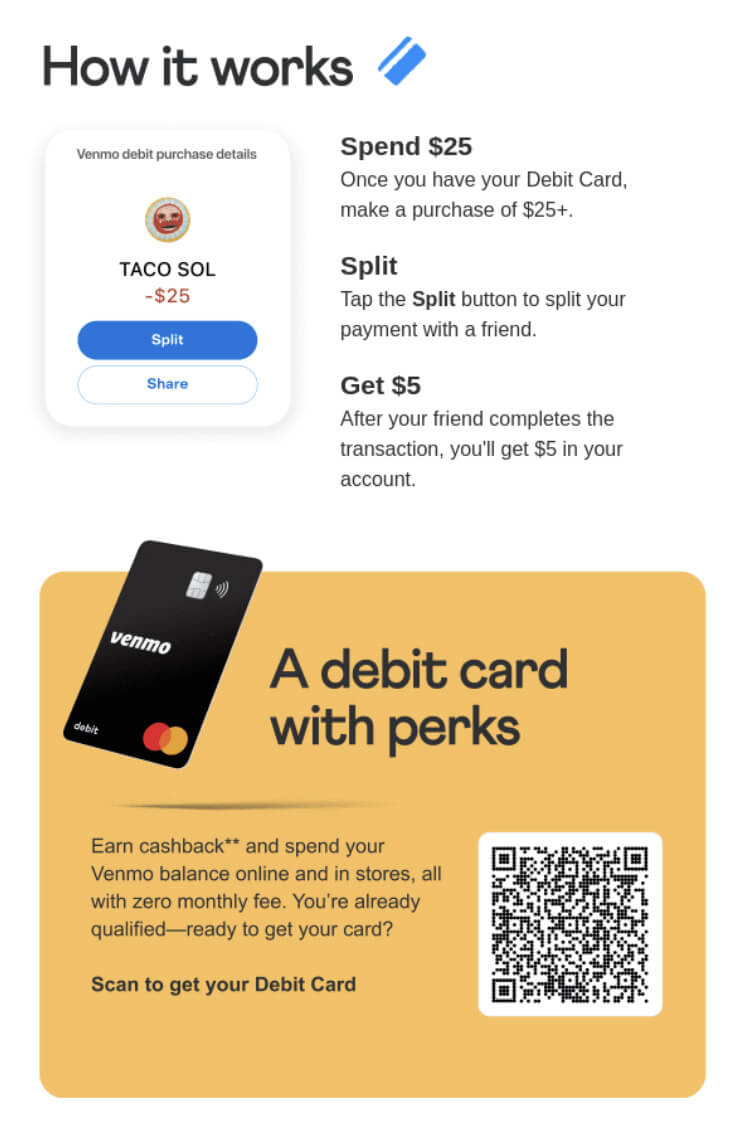

For instance, a credit card provider could prompt a cashback or exclusive perks promotion when a customer is close to reaching a specific spending threshold, encouraging them to spend more. Whilst automated email and SMS notifications can keep customers informed of their progress, nudging them towards the next milestone.

By making rewards visible and attainable, finance brands can inspire customers to spend more during transactions, whilst fostering long-term loyalty in the process.

Source: ReallyGoodEmails

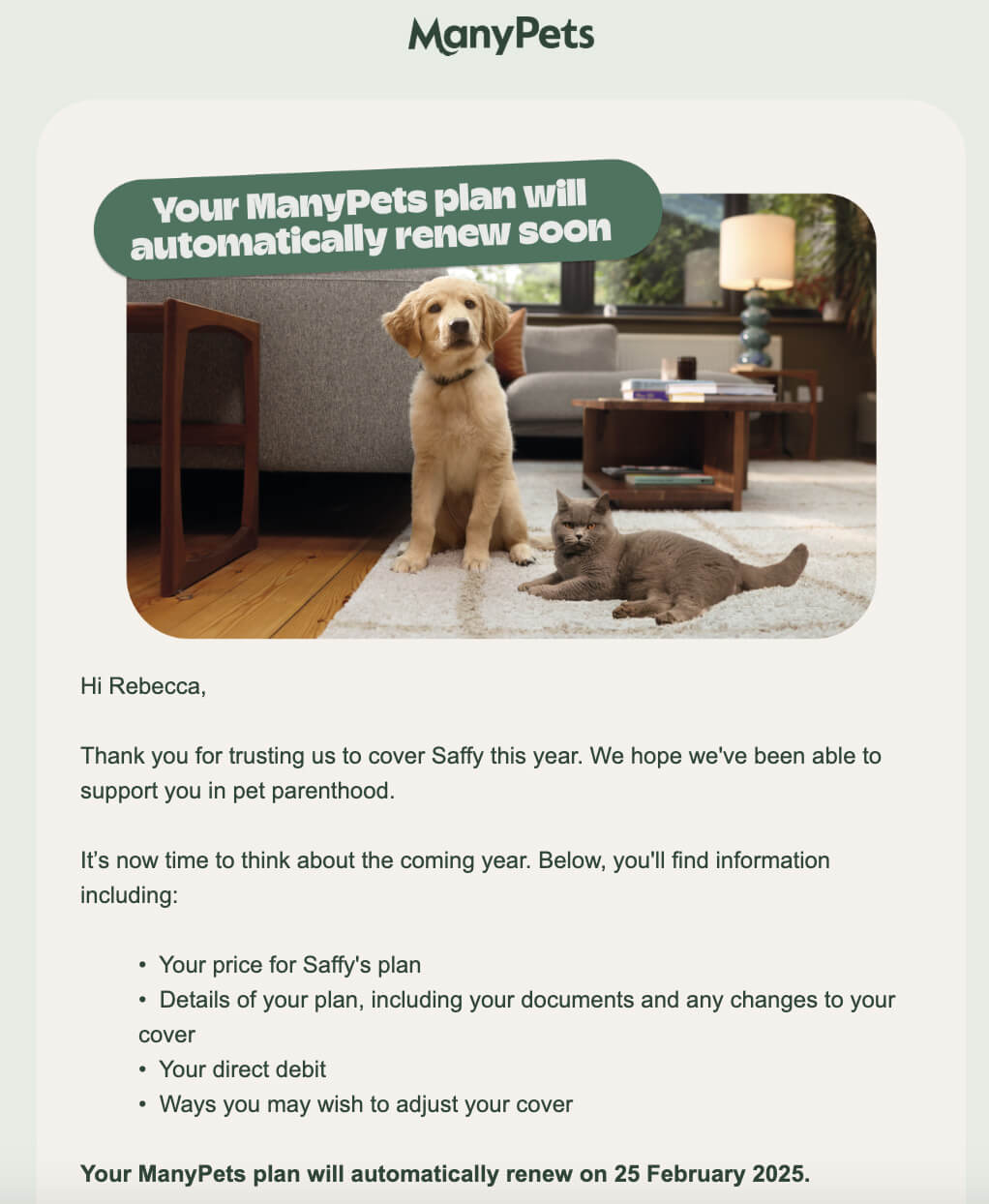

Renewal Reminders and Campaigns

Automated renewal reminders ensure customers never miss a deadline whilst also presenting them with opportunities for improved offerings.

For instance, an insurance provider can send a personalised renewal reminder whilst also suggesting an upgraded package with additional coverage. By offering early renewal discounts or exclusive benefits for premium upgrades, finance brands can reduce the likelihood of customers going to competitors, whilst also increasing overall spend in one seamless process.

Setting Spending Thresholds for Benefits

Encouraging customers to reach specific spending thresholds is a proven way to drive higher transaction values.

With marketing automation, finance brands can monitor customer spending habits and trigger personalised incentives when they are close to a reward milestone.

For instance, an investment brand could reduce fees for customers who increase their range of investments by a certain amount, or a bank might offer free financial advisory services for those maintaining a high account balance.

Furthermore, automated alerts and tailored messages help customers stay informed about their progress, motivating them to reach spending goals whilst feeling rewarded for their loyalty.

Next steps

Marketing automation is clearly a game-changer for finance brands looking to increase their average order value.

From personalised upselling and dynamic bundling to loyalty programmes and renewal campaigns, automation helps deliver targeted, value-driven experiences that encourage customers to spend more whilst feeling supported in their financial journey.

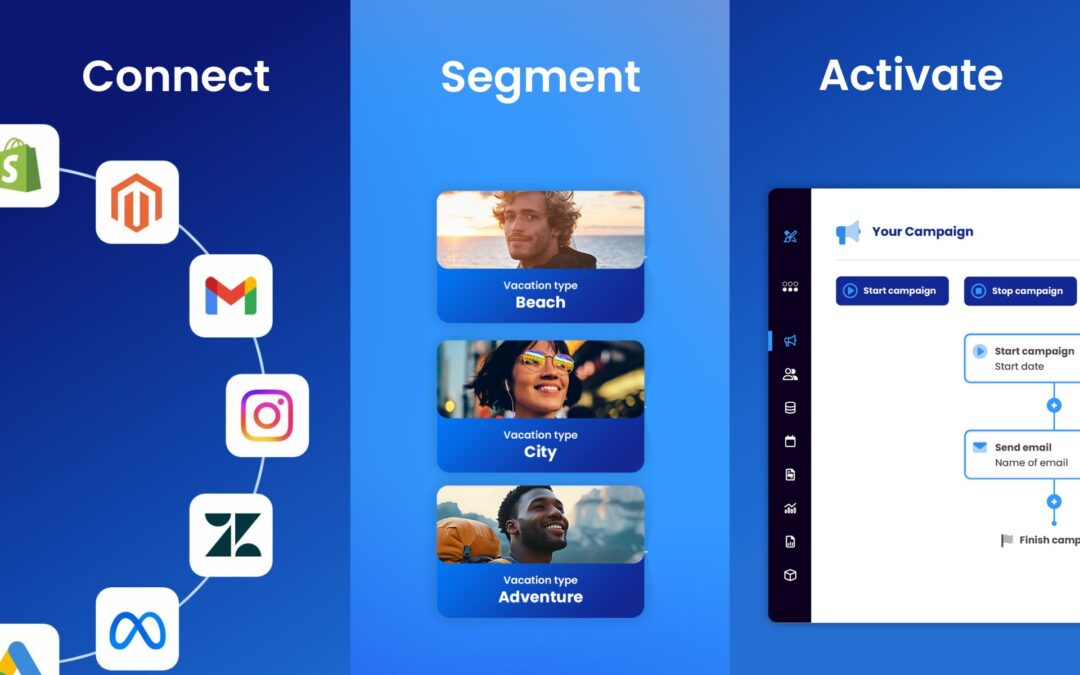

To maximise your AOV strategy, consider a powerful automation platform like Deployteq. With intelligent automation tools tailored for finance brands, Deployteq helps you enhance customer engagement and drive higher-value transactions with ease.

Get in touch to start optimising your marketing strategy with Deployteq.