This is where marketing automation steps in.

By automating key marketing processes, finance brands can cut down on manual effort, maintain compliance, and deliver a seamless experience across multiple channels.

In this blog post, we’ll explore how marketing automation can help marketers in the finance industry to work smarter, not harder.

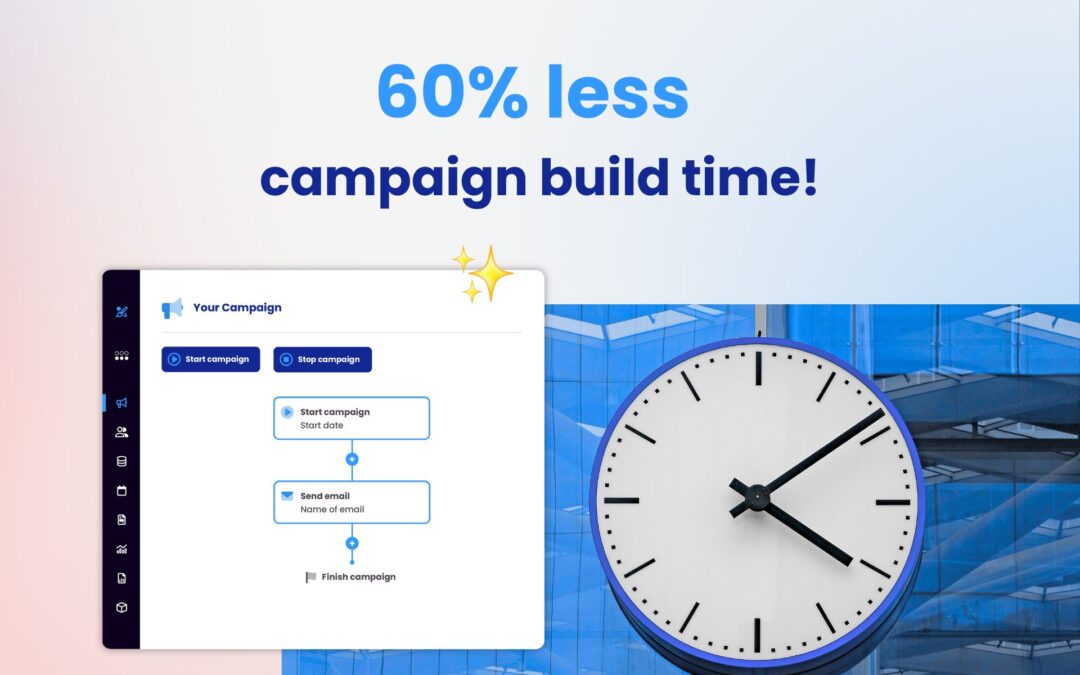

Cutting Out Repetitive Tasks with Automated Workflows

Finance marketing teams can quickly become overwhelmed with manual follow-ups, transactional emails, and tracking customer communications. These manual tasks are not only time-consuming but also prone to errors and inconsistencies.

Fortunately, marketing automation can significantly lighten the load.

By implementing automated sequences, finance marketers can trigger communications based on specific customer actions, requiring minimal manual effort.

These automations can be applied throughout the entire customer journey. For instance, a customer applying for a loan can immediately receive a confirmation email that acknowledges their application and outlines the next steps, ensuring clear communication from the start. Similarly, if a customer starts but doesn’t finish a mortgage application, an automated email can encourage them to complete it.

And existing customers can receive automatic updates about upcoming payments or account reviews, maintaining engagement without direct input from marketing teams.

Beyond email, SMS and WhatsApp automation can be implemented to ensure timely reminders and updates on the platforms customers use most, all without needing to manually send.

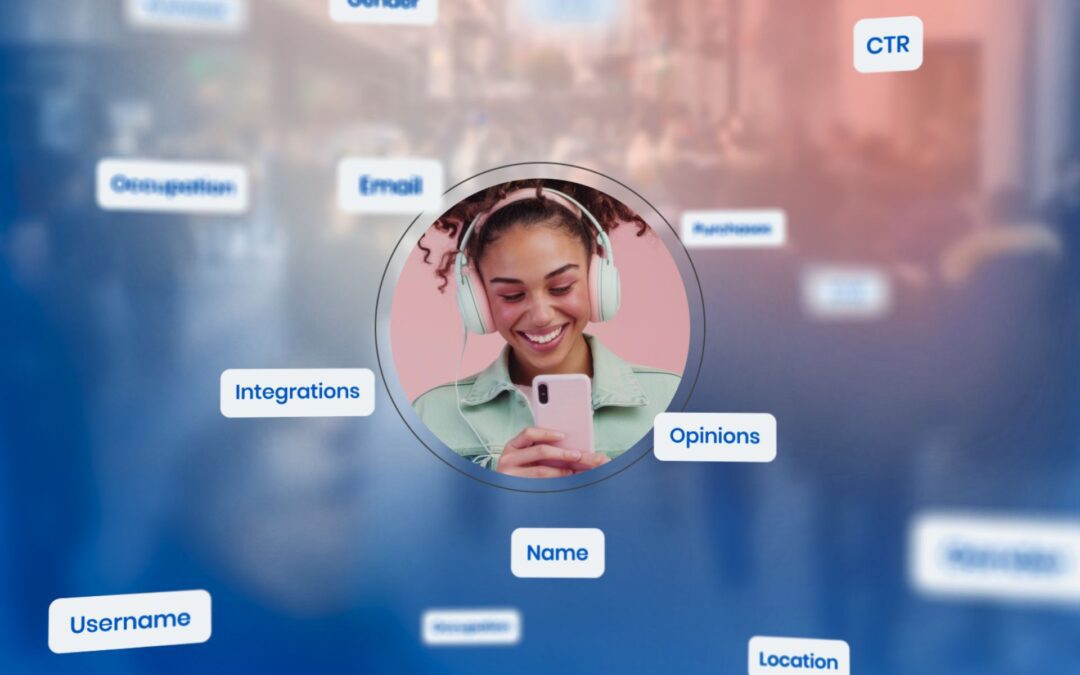

Making Every Interaction Personal, Effortlessly

Finance customers can come in all shapes and sizes, ranging from first-time buyers to seasoned investors, each with distinct needs and goals.

Personalisation is key to keeping them engaged, but manually sending tailored messages to each individual is impossible. Fortunately, marketing automation paired with smart segmentation makes this process achievable.

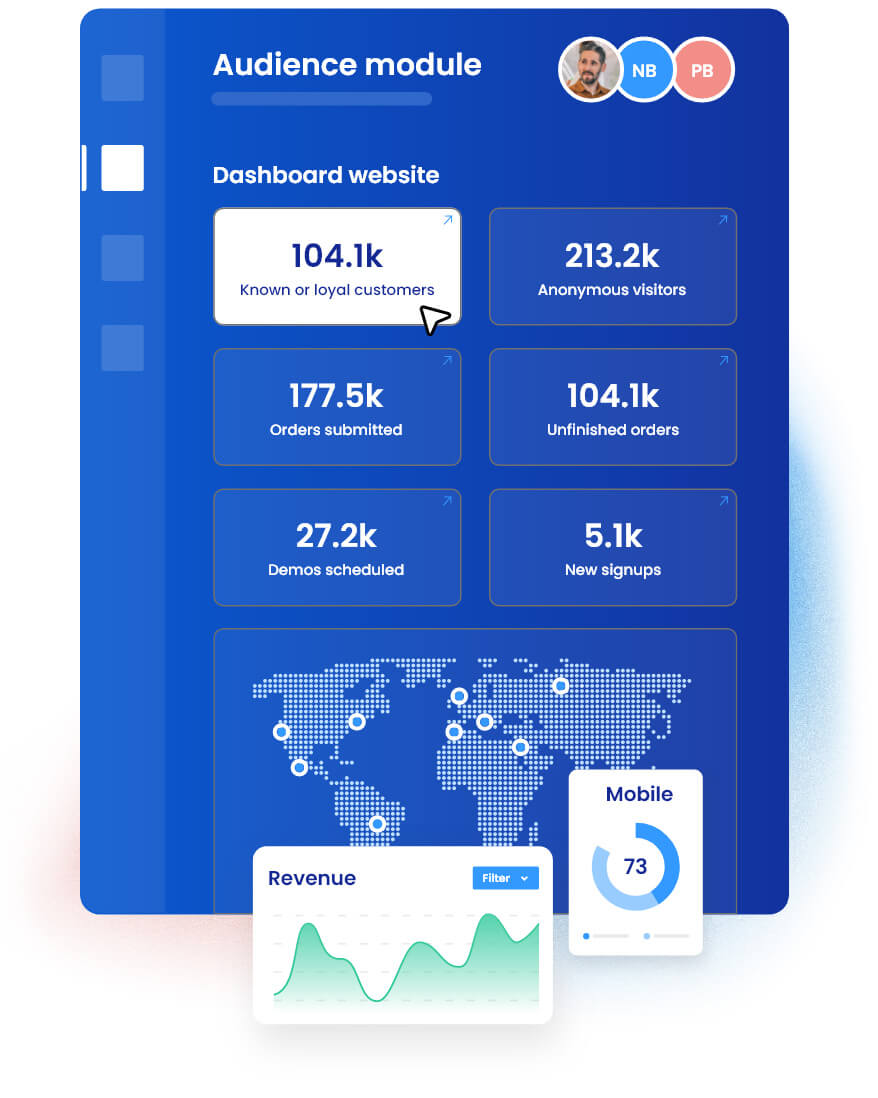

Smart segmentation automatically categorises customers by criteria such as their loan application stage or investment interests. This enables tailored content delivery, such as personalised investment tips to high-value clients, mortgage rate offers to interested buyers, and property guides to first-time homeowners, all effortlessly.

As an additional personal touch, finance marketers can utilise dynamic landing pages to adjust content based on user behaviour, ensuring each visitor receives the most relevant information without ongoing manual updates from marketers.

Staying Compliant Without the Headache

Every customer interaction must adhere to strict legal and security guidelines, but that doesn’t mean marketing has to grind to a halt. In fact, marketing automation can make compliance much simpler by ensuring that everything is done correctly, without added stress or delays.

With built-in approval workflows, automated systems ensure that every message goes through a structured approval process, reducing the risk of anything slipping through the cracks. Secure data handling guarantees that customer information is stored and processed safely, helping businesses stay compliant with GDPR and other regulations. Additionally, easy-to-access data keeps a detailed record of all customer interactions, making audits and compliance checks straightforward and hassle-free.

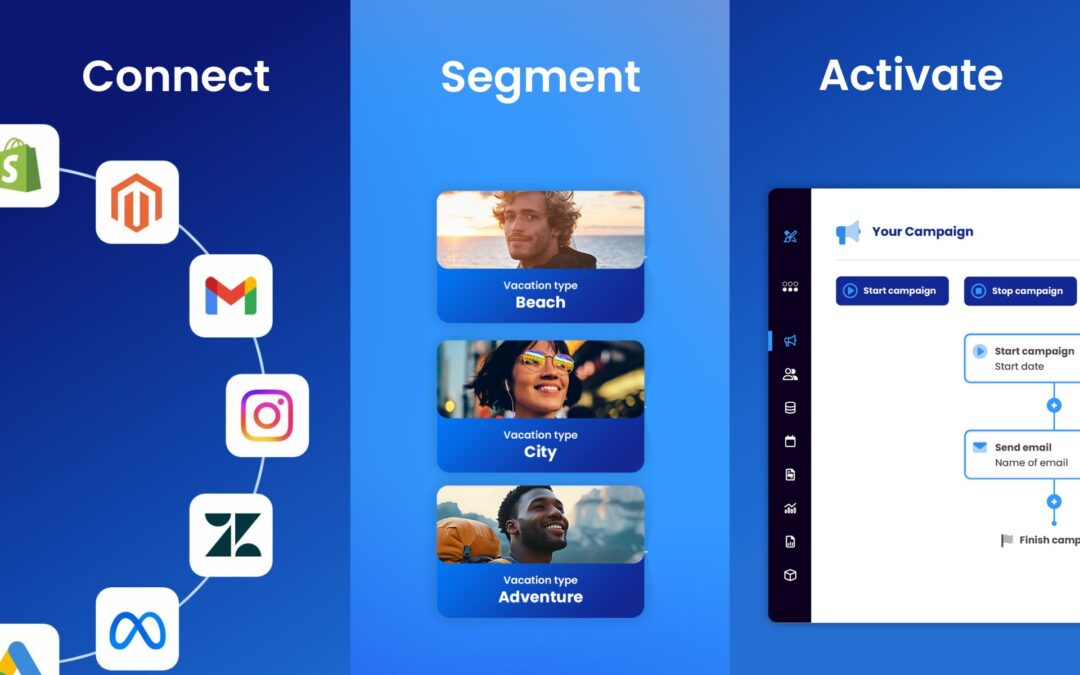

Growing Your Marketing Without Growing Your Team

Traditionally, expanding marketing reach has meant hiring more staff, increasing budgets, and putting in extra hours. But with marketing automation, finance marketers can scale their efforts without overstretching their teams.

For example, automated email campaigns make it easy to send thousands of personalised messages without having to create each one individually. And smart retargeting ensures that engaged customers receive timely follow-ups, whether via email, SMS, or landing pages, keeping communication seamless and relevant.

Consistency across channels can also be simplified, as automation keeps messaging aligned across platforms such as email, SMS, WhatsApp, and websites. Eliminating the need for constant manual updates.

At the same time, lead nurturing happens in the background, guiding potential customers through their decision-making process without requiring hands-on monitoring.

Keeping Customers Engaged (and Coming Back for More)

Gaining new customers is always a win, but the real value lies in keeping them engaged for the long term.

Strong customer relationships don’t happen overnight, they require ongoing communication, timely support, and personalised experiences. Fortunately, marketing automation makes it easy to nurture these relationships without adding additional workloads.

For instance, onboarding sequences can welcome new customers with a series of automated emails, guiding them through account setup, investment options, or loan management. Or, payment reminders can help reduce late payments by sending friendly nudges via email or SMS, improving both cash flow and customer experience.

If a customer hasn’t interacted in a while, a re-engagement campaign can encourage them to check back in with relevant offers or helpful content. And for the most loyal customers, marketing automation can deliver exclusive rewards and personalised incentives, ensuring they stay engaged and invested in your brand.

The options for engagement are endless!

Next steps

Marketing in the finance industry is no small task, but automation makes it easier.

By cutting out manual work, improving personalisation, staying compliant, and scaling efficiently, finance marketers can save time, reduce costs, and keep customers engaged. All without the extra stress.

If you’re ready to work smarter, then Deployteq can help.

Our marketing automation solution is built specifically with finance brands in mind, offering them solutions and support tailored to their needs.

Get in touch to see how Deployteq can help take your finance brand’s marketing to the next level.