When it comes to financial services, marketing is a serious business.

Because loyal customers not only require engaging, timely, and personalised communication. They also need to feel reassured, and that their finances are in safe hands.

That’s where lifecycle marketing automation steps in. By delivering tailored, timely, and relevant messages, brands within the financial services industry can guide customers through every stage of their journey whilst fostering a positive, long-term relationship.

In this blog post, we cover some of our favourite lifecycle marketing automation campaigns that help financial services keep their customers happy, long term.

Welcome and Onboarding Campaigns to Build Confidence

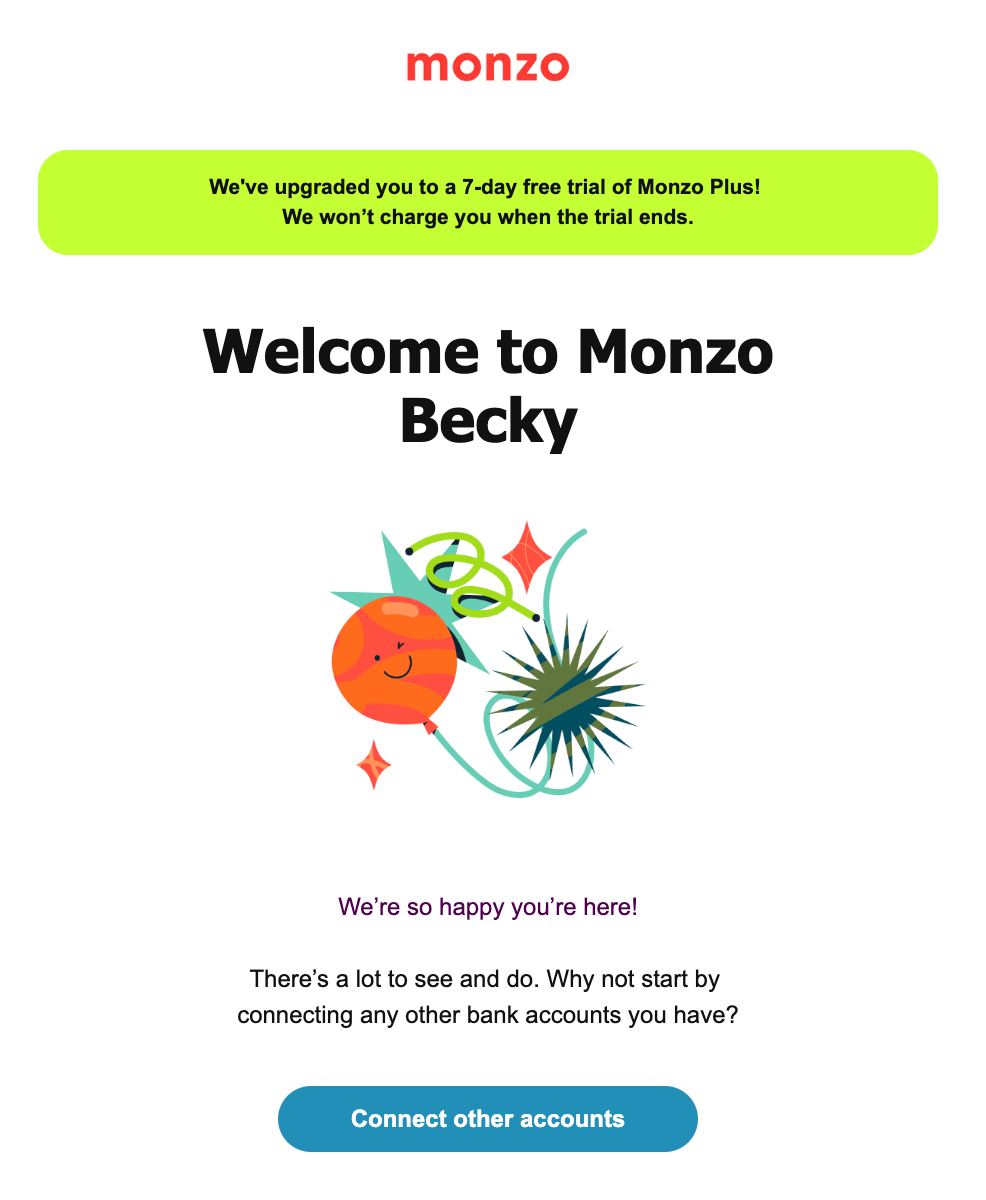

First impressions matter, especially in financial services. Whether opening a bank account, securing a loan, or purchasing insurance, customers want reassurance that they’ve made the right choice.

A considered onboarding campaign provides both a warm welcome and the information customers need to get started confidently.

Brands in this industry should start with clear confirmations and personalised messages stating key information, such as new account details or policy numbers. This can also be expanded to include mobile app set-up, key features of their account or policy, and how to access documentation.

In addition, contact information should be incorporated, such as customer support email and telephone numbers, for easy access.

By combining clear details with actionable next steps, financial services can reduce friction, build trust, and set the foundations for a loyal, long-term relationship.

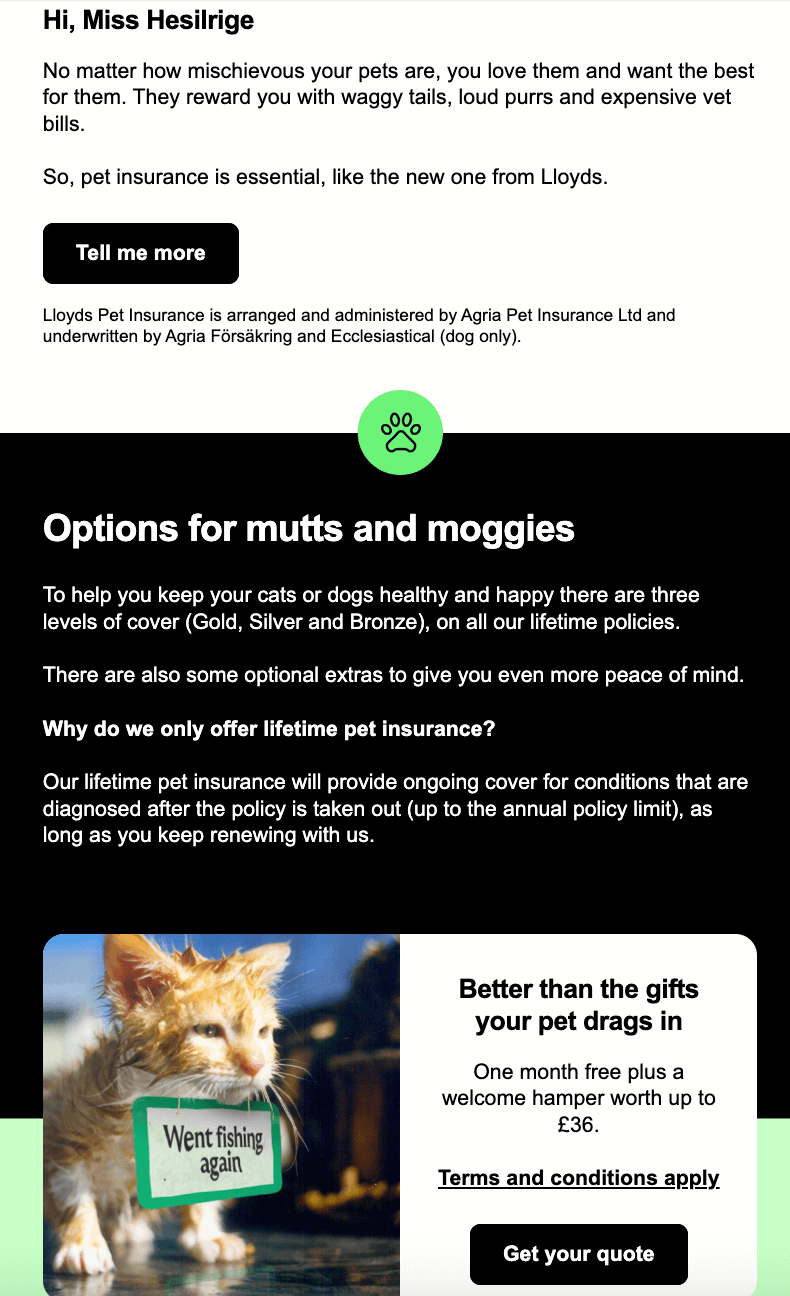

Cross-Sell and Upsell to Meet Customer Needs

Financial customers’ needs evolve over time, and being a brand that anticipates these needs helps to ensure that customers remain loyal.

Lifecycle marketing automation enables brands in this space to utilise behavioural insights to deliver highly personalised recommendations that are not only helpful to the customer, but can also increase revenue for the business.

For example, a banking customer with a current account may benefit from a higher-interest savings account, whilst a home insurance customer could be introduced to add-ons such as personal belongings coverage for their policy.

It’s important to note that these aren’t generic upsell promotions, instead, using data and dynamic content, businesses can offer well-considered, data-driven suggestions that are both relevant and helpful.

Engagement Campaigns to Maintain Relevancy

For example, an insurance company could include home safety advice or ways to lower premiums. Whilst a bank can include information on managing debt or saving for retirement.

The most important element of these campaigns is that they aren’t focused on making a sale, instead, they’re focused on showcasing expertise and offering support proactively.

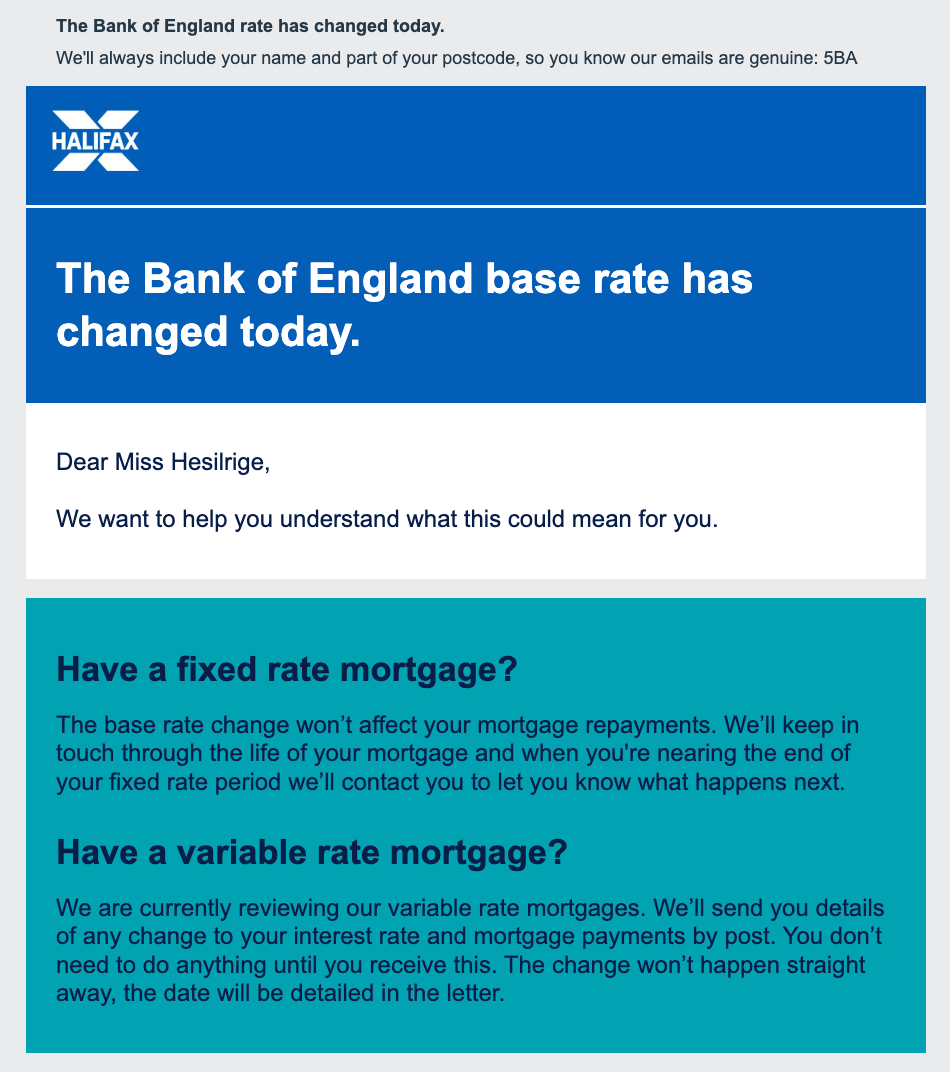

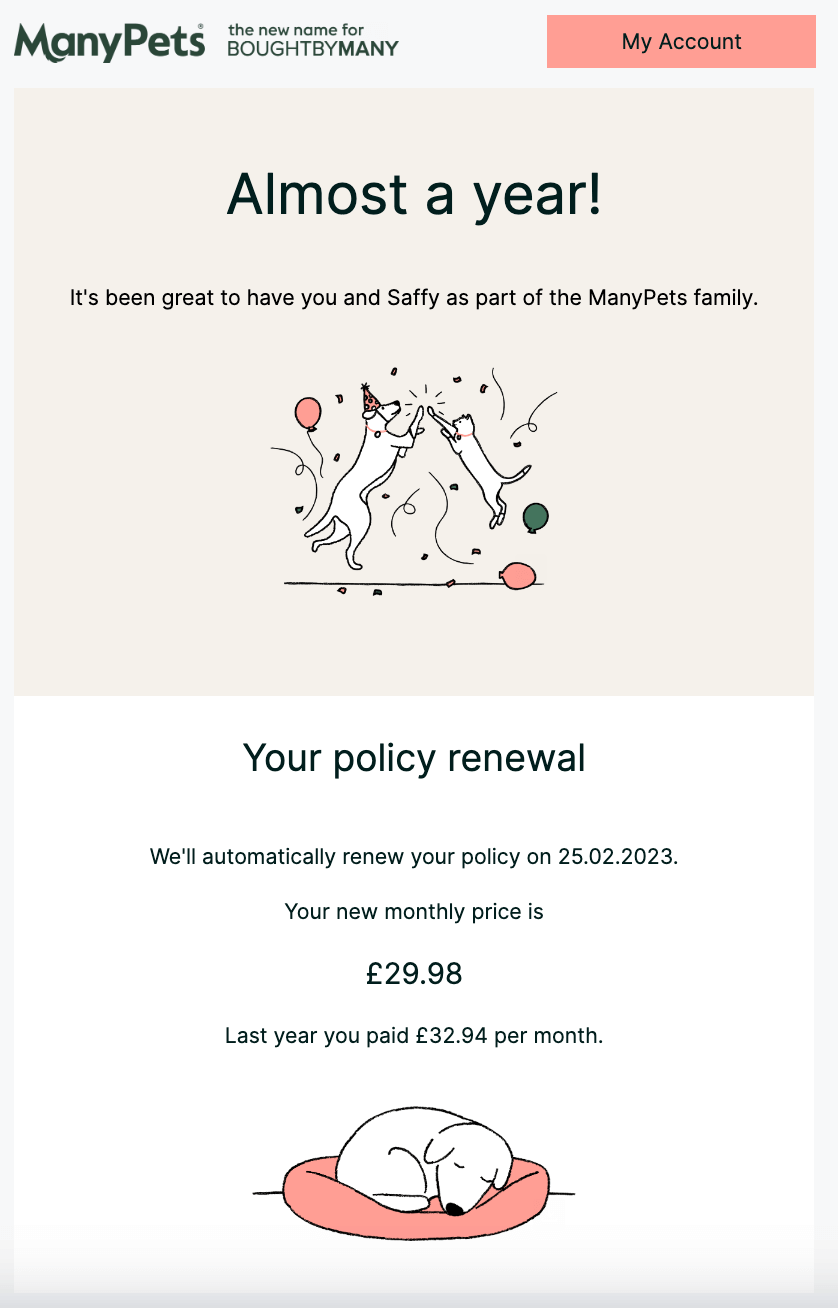

Renewal Campaigns for Seamless Next Steps

Financial products like fixed-term savings accounts, insurance policies, and mortgages often come with an expiration date. A timely renewal campaign ensures customers feel well-cared for during the transition, and are also engaged before they look to competitors.

These automated campaigns can outline the customer’s current product or service, their options for renewing, and even personalised recommendations tailored to their goals.

To add a little sweetener, brands in this industry could also incorporate loyalty discounts or extra benefits for current customers who are renewing.

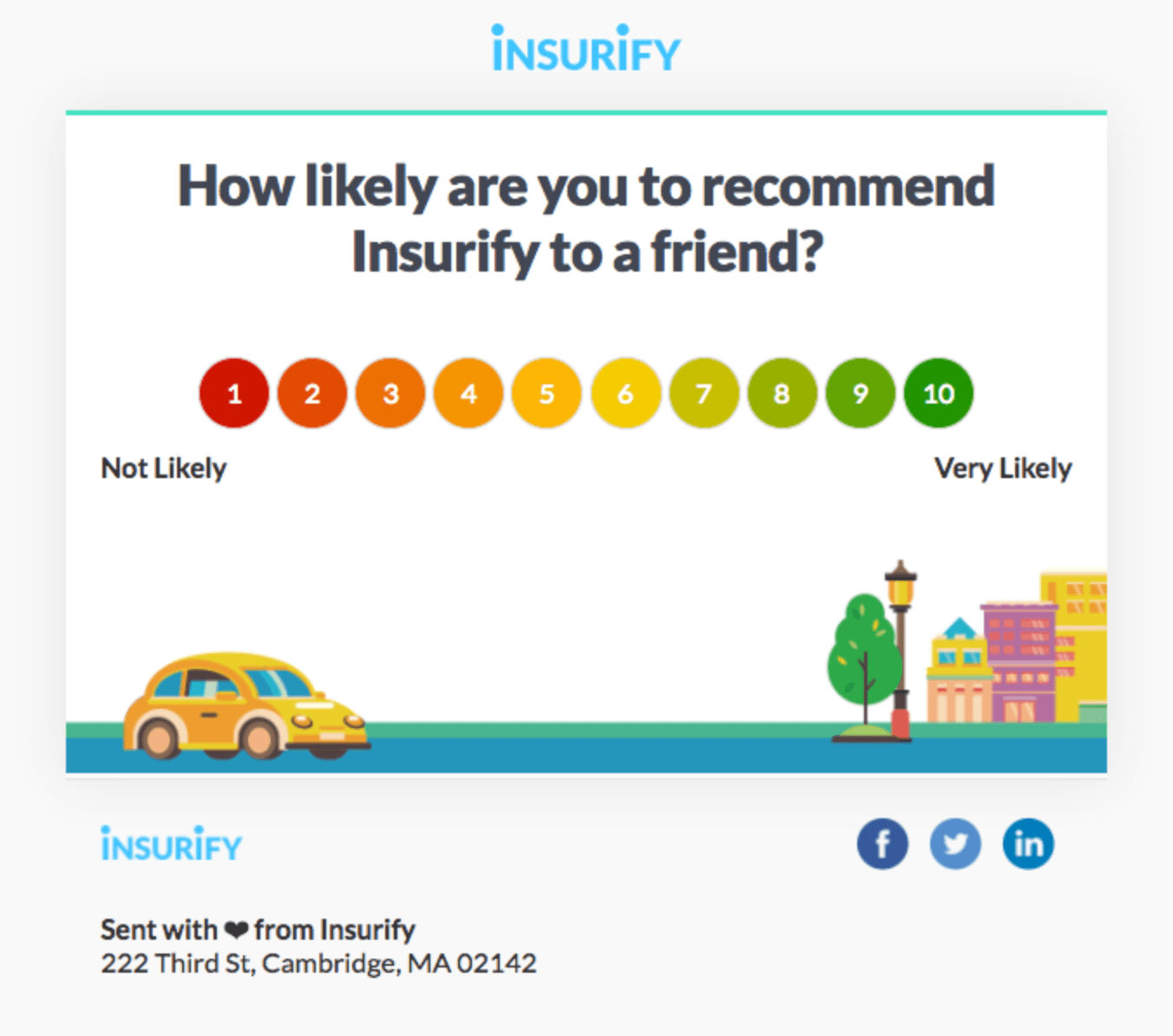

Feedback Campaigns to Build Trust by Listening

Key to maintaining happy customers is ensuring that they feel heard.

Feedback campaigns create opportunities for financial services to show that they are listening to their customers. Whether it’s after a loan application, a claims process, or a policy renewal, asking for feedback demonstrates a commitment to improving the customer experience. Whilst also providing businesses with invaluable data to develop services.

These feedback campaigns can come in a variety of formats, from a simple NPS email, to asking for a review or testimonial.

Even better, actions can be triggered off the back of this feedback. For instance, customers who respond with a low score could be contacted by a customer service representative. Whilst those who leave glowing reviews could be sent referral campaigns.

Source: ReallyGoodEmails

Re-engagement Campaigns to Bring Customers Back

To win these customers back, a re-engagement campaign provides the perfect way to reconnect and rekindle relationships with a timely and engaging outreach communication.

As well as a simple reminder to take the next steps, these emails could include risks of disengaging, such as a lack of home or car cover, as well as the benefits of re-engaging, such as a discount for renewing a policy or promotion of new account features.

Next Steps

For customers, financial services might not have the emotional pull of a favourite retailer or travel brand, but building loyalty in this space is far from impossible.

With the right lifecycle marketing automation strategies, businesses in this industry can create meaningful, long-lasting relationships with customers. When they feel valued, understood, and supported, they’re not only more likely to stick around, they’ll even champion a brand to others.

And whilst loyalty isn’t built overnight, with the right approach, it can last a lifetime.

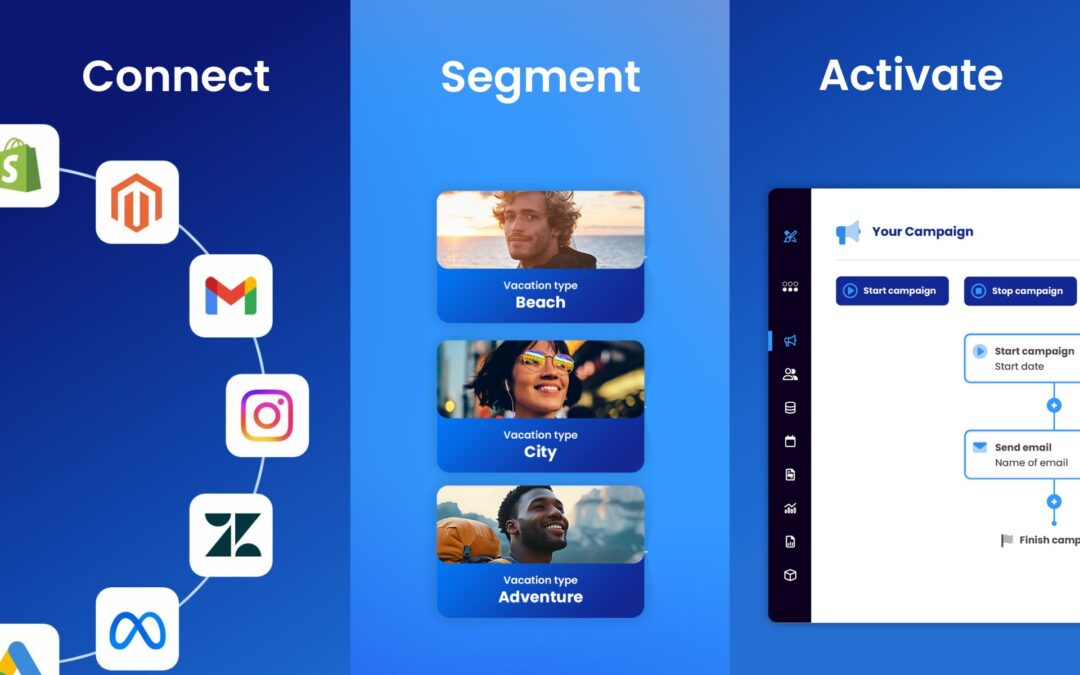

At Deployteq, we specialise in helping financial services harness the power of marketing automation to create these kinds of connections.

Ready to transform your customer relationships? Contact us today to get started.