For any brand in the finance and insurance industry, customer retention is more than just a metric, it’s a key driver of sustained growth and profitability.

Customers today have higher expectations for personalised and timely interactions, especially from brands they trust. Fortunately, marketing automation offers a powerful way for finance and insurance brands to achieve this, enabling them to deliver tailored communications at scale, nurture customer relationships, and build trust from the beginning.

In this blog post, we explore five of our favourite ways that finance and insurance brands can use marketing automation to boost customer retention; demonstrating how considered and strategic communication can make all the difference in a customer’s decision to stay loyal.

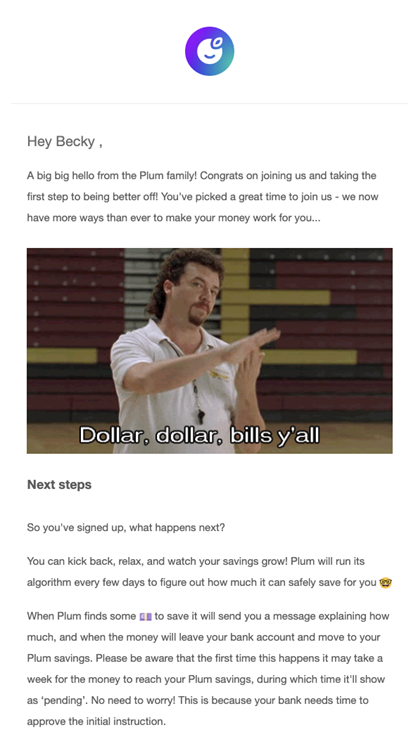

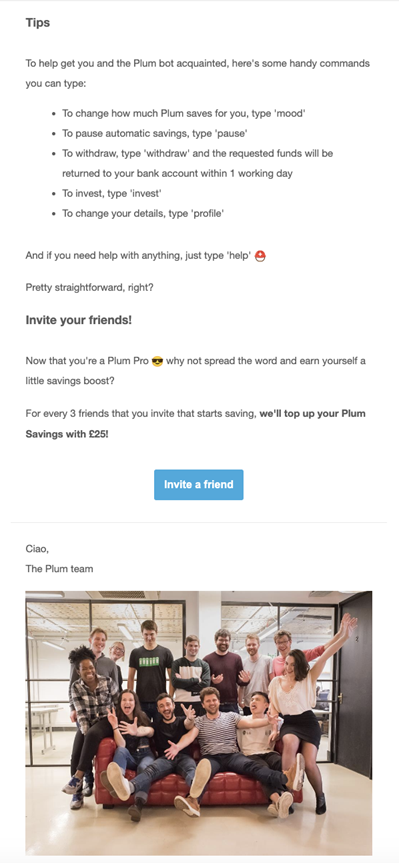

Educational welcome series

First impressions count, especially for brands who rely on building trust with their customer base, and offer complex services that can be daunting for the average consumer.

When customers first sign up with a brand, they are at one of their most engaged stages. Brands can make the most of this and set the tone for future engagement with the use of a warm welcome and the sharing of educational content.

Marketing automation can be utilised to send a seamless welcome series that guides customers through a brand’s offering. From a simple introduction and contact details, then gradually ramping up to information on policies, investments, and financial products.

The goal of these campaigns isn’t just to sell, but to further engage. So brands should consider truly helpful content. Consider steps to account set-up, guides to terminology, and introductions to basic products and policies. And this content can come in a variety of formats, including infographics, PDF guides, and videos.

By offering a warm welcome and being supportive, brands in finance and insurance can position themselves as accessible experts in their industry, increasing the chances of customers staying with them in the long term.

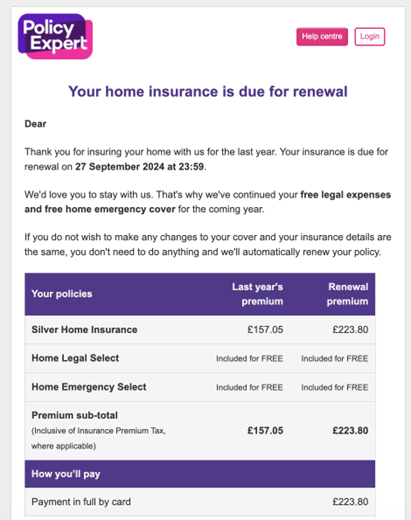

Date-based renewal reminders

Date-based renewal reminders provide proactive communications to encourage customers to remain with a brand at a pivotal time when the potential for customer churn is high.

These reminders ensure that customers are aware of upcoming renewal dates for their policies, loans, or other financial products. By receiving these reminders ahead of time, customers have the opportunity to make informed decisions without feeling rushed.

However, another benefit of these reminders is that they allow the brand to promote their services and reinforce their relationship with customers before they look to a competitor. Thus reducing the chance of customer churn.

Additionally, these reminders showcase how engaged the brand is with its customer base by reducing the chance of last-minute administrative stress or lapses in services, which could otherwise lead to unhappy customers.

Support and follow-up communications

In sectors where customers often deal with complex processes, such as filing claims, processing loans, or managing financial products, clear and proactive communication can significantly enhance the customer experience.

That’s why automated support and follow-up communications are critical for building trust with a customer base, and keeping customers reassured during these key moments.

These automated communications should aim to keep the customer informed at every stage of their interaction, such as acknowledging receipt of a claim, providing status updates, outlining the next steps, and even offering copies of chat transcripts.

This transparency helps reduce customer anxiety and builds trust, especially during stressful times when they need reassurance and guidance.

Additionally, follow-up emails after an interaction can gather valuable feedback, allowing brands to identify any potential issues early on and provide quick resolutions that showcase their commitment to customer care.

Re-engagement campaigns for inactive customers

Re-engagement campaigns are valuable for customer retention as they target customers who may otherwise be lost to inactivity or competitors.

These campaigns are designed to grab interest, remind customers of the value of the brand, and offer a call to action to re-engage.

Re-engagement campaigns can be particularly effective as they provide an opportunity to address any needs, changes in customer circumstances, or market conditions that may have led to the inactivity. And by offering personalised content or incentives, brands in the finance and insurance industry can demonstrate that they understand the customer, and are responsive to their evolving needs.

In addition, these campaigns can leverage data to segment customers based on their inactivity duration and past behaviour, which when combined with dynamic content can be used to create highly targeted communications, incorporating copy, content, and information that is highly tailored to each individual.

Customer feedback surveys

Understanding customer sentiment is crucial for brands in the finance and insurance industry to improve their services and retain customers, long-term.

Marketing automation can streamline the process of collecting feedback by sending automated surveys at key touchpoints in the customer journey. Whether this is after a customer service interaction, a claim process, or a consultation, feedback collection can provide invaluable insights into what customers liked or disliked about their experience.

Brands in this industry can then use this data to make strategic decisions on their products and services, and improve the overall customer experience for retention purposes.

These campaigns also offer a positive experience for the customer. Demonstrating that the brand values their experience and feedback, whilst offering them a private space to report any dissatisfaction before turning to public review sites.

Next steps

In an industry where trust and reliability are key for building long-term relationships, marketing automation offers a powerful solution that enables brands in finance and insurance to deliver timely, engaging, and relevant communications at scale.

From automated welcome campaigns to proactive service notifications, re-engagement, and support to feedback surveys, marketing automation helps finance and insurance brands to stay connected with their customers in a meaningful way.

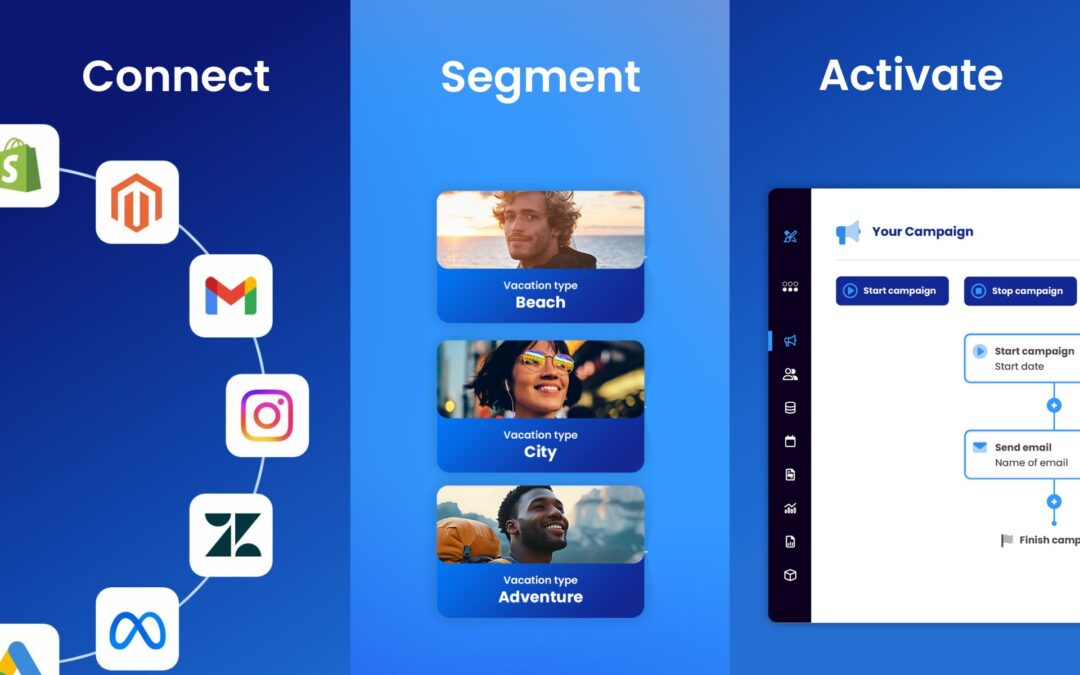

Investing in marketing automation is not just about keeping up with the competition, it’s about staying ahead. By working with a solution such as Deployteq, brands in the finance and insurance industry have access to experts in their industry, alongside a leading marketing automation suite.

If this sounds of interest, then get in touch with us to find out more.