Finance brands often face a unique challenge: how do you build trust and stay competitive in an industry that demands accuracy and personalisation?

The answer is marketing automation. A powerful tool that enables finance brands to engage with potential customers in a more efficient, yet personalised way.

Whether you’re helping a potential customer choose a credit card, walking them through a mortgage application, or simply introducing them to your services, marketing automation can guide prospects through each stage of their decision-making process to finally becoming a customer.

In this post, we’ll explore seven practical ways that finance brands can use marketing automation to grow new customers, and explore why it’s quickly becoming an essential tool in today’s financial landscape.

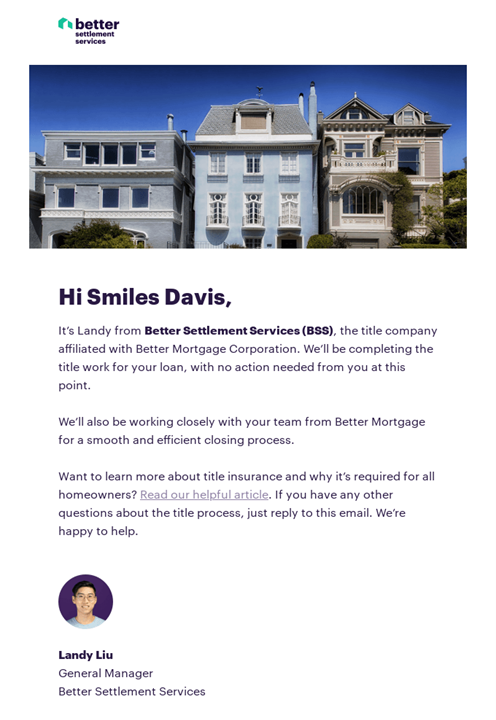

Welcome campaigns to set the tone

Making a positive first impression with a prospect can make all the difference in securing their custom, especially in the finance industry where trust and reliability are key. A well-thought-out welcome campaign can be ideal for introducing new prospects to a finance brand whilst building a positive foundation for future engagement.

When a potential customer engages with a finance brand, whether that be signing up for a newsletter, requesting a quote, or signing up for an account, it’s the perfect time for them to receive an automated welcome series.

This series can offer them a warm welcome to the brand, a brief overview of services, educational content, and key contact details.

By delivering a series of informative emails, finance brands can set the tone for a long-term relationship, increasing the likelihood that these new subscribers will convert into paying customers.

Furthermore, welcome campaigns generate 4x more opens and 5x more clicks than regular email marketing campaigns. Making them a reliable option for brands to invest time into.

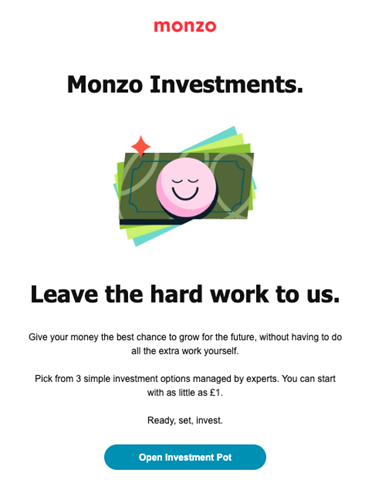

Personalised lead nurturing

One of the most significant advantages of marketing automation is the ability to run personalised campaigns that nurture leads based on their behaviour and interests.

Finance customers will often need time to make informed decisions, whether they’re choosing a credit card, signing up for a savings account, or considering a mortgage. And with automation, finance brands can set up an email series that gradually educates prospects and guides them through this decision.

For example, a mortgage lender can create a nurturing campaign that begins with a welcome email, followed by emails about different mortgage options, interest rates, customer testimonials, and how to apply. These emails are triggered based on user behaviour, such as visiting specific website pages or downloading resources.

By guiding prospects through the decision-making process, nurturing campaigns ensure that potential customers receive the right information at the right time, keeping them engaged and more likely to convert.

Behavioural targeting for new customer segments

Customer acquisition in the finance industry relies heavily on understanding the unique needs of different customer segments. And with email marketing automation, finance brands can target these specific groups based on their behaviour to ensure they are receiving the most relevant content to their behaviour.

For example, if a user shows interest in retirement planning by frequently visiting a retirement savings landing page, or clicking on retirement-related emails, marketing automation can segment them into a specific “retirement planning” group. From there, they’ll receive targeted content such as retirement guides, calculators, or investment plans tailored for retirement.

This segmentation leads to higher engagement rates, as each customer receives content relevant to their own financial journey.

Lead scoring for high-value prospects

Finance brands often deal with large volumes of leads, but not every lead is ready to become a customer. Email marketing automation, combined with lead scoring, can help prioritise which leads are the most valuable based on their engagement with email communications and landing pages.

Lead scoring assigns a numerical value to each lead based on factors such as the number of emails opens, links clicked, pages visited, or forms completed. Then once a lead reaches a certain score, the marketing automation system can trigger additional actions, such as sending a personalised offer or notifying the sales team to reach out personally.

For example, a prospective customer who frequently clicks on content about personal loans and completes a loan calculator could receive an email offering a personal consultation.

This method helps finance brands to focus their efforts on high-potential leads, reducing wasted time and maximising their return on marketing efforts.

Educational content to build trust

Finance brands deal with complex products and services that often require an in-depth understanding from customers before they make a decision.

One effective way to acquire new customers is by offering educational content through automated email campaigns. These campaigns can position the brand as an expert in the financial space, providing value to potential customers and gradually earning their trust.

For example, a bank could create an educational email series about different types of investment options, or a credit card provider could send out a guide on how to improve credit scores.

Each email in the series can build on the previous one, slowly guiding prospects through various financial topics relevant to their needs. This not only helps in nurturing leads but also in demonstrating the brand’s expertise and trustworthiness, which is essential for acquiring new customers in this industry.

Abandonment campaigns to recover lost leads

A common challenge for finance brands is abandoned applications, where potential customers start filling out a form for a loan, credit card, or account, but don’t complete the process. Email marketing automation can be used to recover these leads by triggering timely reminders and incentives to encourage them to complete their form.

For example, when a prospect abandons an application, an automated email can be triggered reminding them to complete the process. This email can include a friendly reminder that the application is incomplete, a clear link back to the form, and an offer to encourage action, such as a discounted fee.

This strategy can significantly reduce the number of lost leads and increase conversions by gently nudging prospects back to the application form.

Re-engagement campaigns for disengaged prospects

Not every potential customer will convert right away, and some may even go cold after showing regular interest.

Fortunately, re-engagement campaigns can be a powerful tool to revive these disengaged prospects and bring them back into the sales funnel.

For example, if a prospect has stopped interacting with emails after a certain period, finance brands can automatically trigger a re-engagement campaign to entice them back. These campaigns could provide an overview of services, customer testimonials, or even a limited-time offer.

By proactively reaching out to these cold leads, finance brands can reignite interest and convert prospects who may have otherwise been lost.

Next steps

When it comes to customer acquisition in the finance industry, trust and timing are key.

Consumers want to know they’re making the right decisions with their money, and they want to feel supported at every step.

Marketing automation enables finance brands to build that trust by delivering the right message at the right time, without constant manual effort. From drip campaigns that nurture leads to abandoned application reminders that recover lost prospects, marketing automation makes customer acquisition efforts more effective and scalable.

If you’re a finance brand looking to connect with potential customers in a more meaningful way, Deployteq can help you create campaigns that not only convert but also build lasting relationships. Because it’s not just about acquiring new customers, it’s about creating an experience that keeps them coming back.

Contact our team of experts today to find out more.