No matter the industry, maximising return on investment (ROI) is essential for sustaining long-term growth and profitability.

But when it comes to an industry grounded in understanding finances inside-out, it is particularly disheartening if ROI is taking a hit.

Fortunately, marketing automation can help brands within the finance and insurance industry that are struggling to boost ROI.

By automating key touchpoints, businesses in this industry can enhance their communications, engage with their audience, and ultimately increase conversions. All of which leads to an impressive return on investment.

In this blog post, we’ll explore five tactical ways marketing automation can boost ROI for finance and insurance brands, focusing on specific campaigns, and featuring real-life examples.

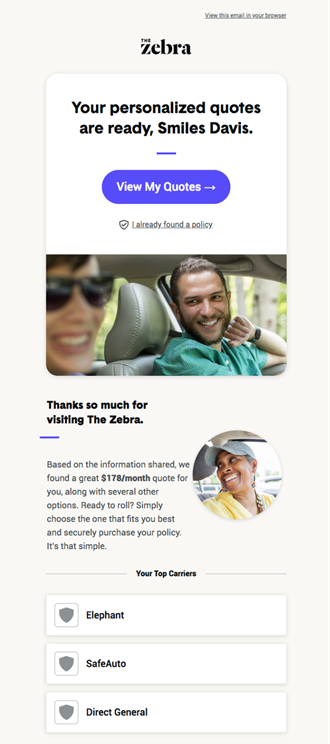

Completed quote follow-up

A completed quote follow-up campaign can significantly boost ROI for finance and insurance businesses by capitalising on prospects who have received a quote but haven’t yet taken the next step.

After a potential customer completes a quote, they are often still in the decision-making process, comparing options or considering their financial situation. A follow-up campaign ensures the brand remains at the forefront of their mind, encouraging them to convert.

By automating follow-ups, businesses can send targeted email marketing that reinforces the value of the quote they received. For example, the first follow-up can thank them for requesting a quote and provide next steps, coverage selected, and a clear call to action to accept the quote. The next emails can include customer success stories, personalised content, or emphasise how the product meets their specific needs.

Providing limited-time offers, exclusive discounts, or incentives such as free add-ons can also help to create urgency and drive action. Additionally, follow-ups can address common concerns or questions about the policy or financial product, making the customer feel more confident in their decision.

Abandoned quote follow-up

We’ve covered engaging with customers who complete quotes, but what about those who don’t?

In the finance and insurance sectors, customers often request quotes for services such as loans, mortgages, or insurance policies, but simply do not complete the process. This can be due to a multitude of reasons, such as being distracted, needing to do more research, or finding a better deal elsewhere.

An abandoned quote follow-up email campaign can help capture these lost opportunities by reminding customers to finish their quote, or by providing additional incentives to encourage completion.

This campaign can begin a few hours after the quote was started, to offer a gentle reminder and a link back to the process. A second email, sent a day or two later, could offer additional information and support details, or even a limited-time discount to incentivise completion.

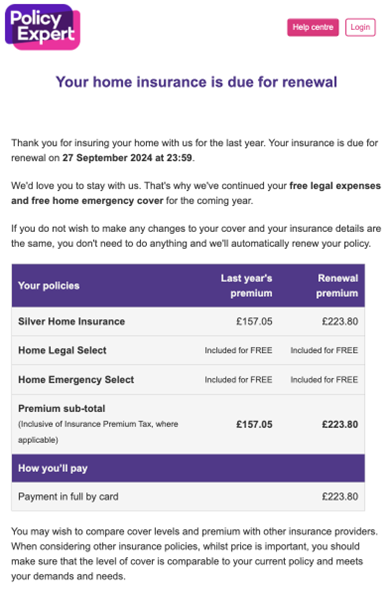

Payment and renewal reminders

Both email and SMS reminders can be incredibly effective for prompting customers to take timely action on payments and policy renewals. Not only does this help to reduce the risk of policy lapses and late payments, but also makes the process of renewing or paying even easier for the customers, increasing the chances of completion.

These reminders can be sent automatically to customers who have upcoming due dates, ensuring they stay on top of their financial commitments.

We would recommend sending the first reminder roughly a week before the payment or renewal is due, followed up by one day before. A direct link to the payment or renewal page should be included to make the process smoother, reducing churn rates and ensuring consistent revenue flow.

Cross-sell and product recommendations

Using customer data, finance and insurance brands can run targeted cross-sell campaigns to suggest relevant products and services. This could be in the form of segmented campaigns, where the same offer is sent to specific segments that share demographics or behaviours in common. Or, with the use of dynamic content, marketers can send promotions that are tailored to each individual, based on their own data.

For example, if a customer has a savings account, they could be targeted with upsell emails promoting paid-for savings accounts that come with added benefits.

We would recommend that each email features personalised content that explains the benefits of the suggested product, providing clear calls to action to learn more or sign up. This approach encourages the engaged recipient to spend more, boosting revenue in the long run.

Re-engagement campaign for dormant customers

Dormant or inactive customers represent serious untapped potential for ROI. These customers are likely already aware of the brand, their offering, and their processes, meaning less effort is required for initial engagement.

Instead, a re-engagement email marketing campaign will specifically target customers who have not interacted with the brand for a certain period, encouraging them to return by offering valuable content, updates, or promotions.

Brands in the finance and insurance industry can identify customers who have been inactive for a set period, and segment them for the re-engagement series.

The first email could express a friendly “We Miss You” sentiment and offer a relevant piece of content, such as a financial planning guide or investment tips.

Follow-up emails could provide special promotions, like a reduced rate on a new loan or a bonus for opening a new account. In addition, including testimonials, case studies, or success stories can also help rekindle interest and trust.

The goal is to remind dormant customers of the value they initially saw in the brand, prompting them to re-engage and convert, which directly boosts ROI.

Next steps

It’s clear that marketing automation can be a crucial tool for finance and insurance brands looking to streamline their customer interactions and drive more value from their marketing efforts.

From following up on completed and abandoned quotes to encouraging timely renewals and cross-selling relevant products, these tactical campaigns not only increase conversion rates but also improve customer satisfaction and retention. Ultimately leading to a significant boost in ROI.

As a marketing automation solution that specialises in helping businesses in the finance and insurance industry, we have a wealth of experience in improving ROI using a range of marketing channels.

So, why not get in touch today to learn more?